Altech – Listed Green Bond Preparations Progressing Well

Highlights

- Listed green bond targeting an offer of ~US$144m

- Preparation progressing well and on track

- HPA project 49% less carbon footprint than conventional HPA

Altech Chemicals Limited (Altech/the Company) (ASX: ATC) (FRA: A3Y) is pleased to advise that preparations for its proposed listed green bond offering of ~US$144 million, to provide additional financing for its Malaysian high purity alumina (HPA) project are on track and progressing well.

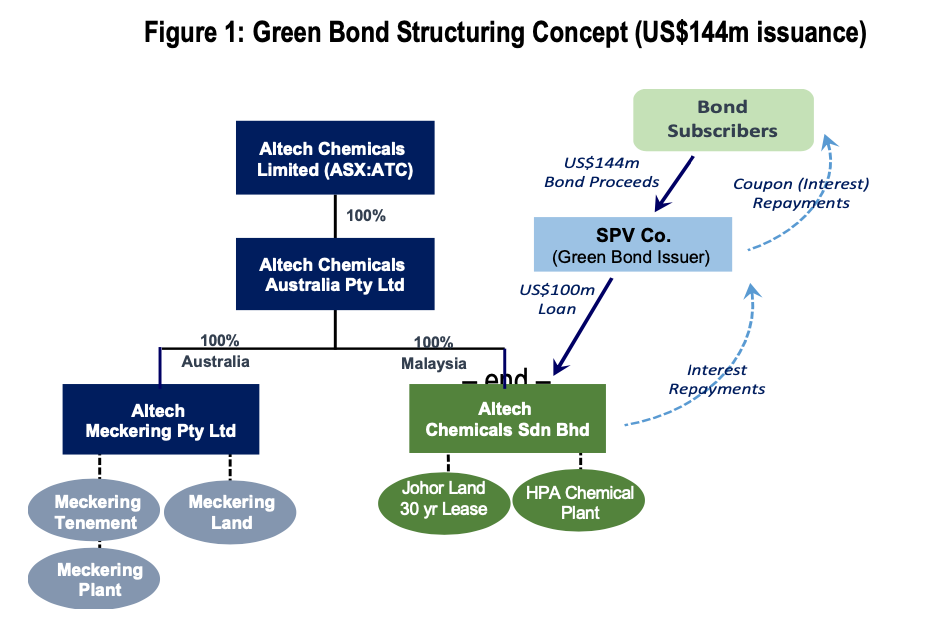

Altech is working closely with London based structuring agent, Bedford Row Capital PLC (Bedford Row) and Bluemount Capital (WA) Pty Ltd (Bluemount) to prepare for a Bond offering. Preparations for the offering commenced in December 2020, and have now progressed to a point where due diligence is complete – including an environmental social governance (ESG) audit; a draft facility agreement is distributed; and a preliminary offering document is being reviewed. Altech is aiming to raise US$144m from the proposed bond issue, of which US$100m will be used as secondary debt for its Johor HPA plant (with US$44m to service bond interest during the HPA plant construction phase – see Figure 1). Senior project finance of US$190m is already committed from German government owned KfW IPEX-Bank.

The bond issue process consists of the initial preparation phase (currently underway), where legal documentation, structures, teasers, draft investment memorandum, and comprehensive corporate presentation packs are developed and then distributed to prospective subscribers. This is followed by the opening of a data room for a bookbuild phase, which will only initiate upon positive “soft soundings” during the preparation phase, and will optimally be conducted in a period of positive overall market sentiment.

The final phase of the bond issue is execution, when commitments are settled and bond proceeds formally deposited with the SPV Co. (closing). Application for listing the bonds on the Frankfurt Stock Exchange would be made following the closing. Preparation work is progressing well and on schedule.

Background

Increasingly green bonds are being used to finance new and existing projects which deliver environmental benefits and a more sustainable economy. As announced on 20 May 2020, Altech’s HPA project has been formally assessed as “green” by the independent Centre of International Climate and Environmental Research (CICERO) based in Oslo, Norway. Compared to conventional HPA processing, Altech’s disruptive HPA production technology is estimated to deliver a ~49% reduction in the comparable carbon footprint, and use ~41% less energy. Also, the primary end-use for Altech’s HPA is targeted for climate change products, such as LEDs lights and lithium-ion batteries.

As illustrated in Figure 1 below, a Special Purpose Vehicle (SPV Co.) would be incorporated and managed by Bedford Row Capital (or its nominee) as the proposed bond Issuer. From a US$144m issue, US$44m would be retained by the SPV to service bond coupon (interest) payments during the period of Altech’s HPA plant’s construction and commissioning. The US$100m balance of proceeds is lent by the SPV Co. to Altech’s Malaysian subsidiary (Altech Chemicals Sdn. Bhd.) to part-fund plant construction costs and/or for working capital. It is envisaged that the bond will be for an initial 5-year term, and typical of this type of funding would likely be re-financed at a lower coupon (interest rate) towards the end of the term. The SPV Co. would take second lien security behind senior lender KfW IPEX-Bank.

For more information, please contact:

Corporate

Iggy Tan

Managing Director

Altech Chemicals Limited

Tel: +61 8 6168 1555

Email: info@altechchemicals.com

Shane Volk

Company Secretary

Altech Chemicals Limited

Tel: +61 8 6168 1555

Email: info@altechchemicals.com

Investor Relations (Europe)

Kai Hoffmann

Soar Financial Partners

Tel: +49 69 175 548320

Email: hoffmann@soarfinancial.com Wir sprechen Deutsch.

About Altech Chemicals (ASX:ATC) (FRA:A3Y)

Altech Chemicals Limited (Altech/the Company) is aiming to become one of the world’s leading suppliers of 99.99% (4N) high purity alumina (Al2O3) through the construction and operation of a 4,500tpa high purity alumina (HPA) processing plant at Johor, Malaysia. Feedstock for the plant will be sourced from the Company’s 100%-owned kaolin deposit at Meckering, Western Australia and shipped to Malaysia.

HPA is a high-value, high margin and highly demanded product as it is the critical ingredient required for the

production of synthetic sapphire. Synthetic sapphire is used in the manufacture of substrates for LED lights,

semiconductor wafers used in the electronics industry, and scratch-resistant sapphire glass used for

wristwatch faces, optical windows and smartphone components. Increasingly HPA is used by lithium-ion

battery manufacturers as the coating on the battery’s separator, which improves performance, longevity and

safety of the battery. With global HPA demand approximately 19,000t (2018), it is estimated that this demand

will grow at a compound annual growth rate (CAGR) of 30% (2018-2028); by 2028 HPA market demand is forecast to be approximately 272,000t, driven by the increasing adoption of LEDs worldwide as well as the demand for HPA by lithium-ion battery manufacturers to serve the surging electric vehicle market.

German engineering firm SMS group GmbH (SMS) is the appointed EPC contractor for construction of Altech’s Malaysian HPA plant. SMS has provided a USD280 million fixed price turnkey contract and has proposed clear and concise guarantees to Altech for plant throughput and completion. Altech has executed an off-take sales arrangement with Mitsubishi Corporation’s Australian subsidiary, Mitsubishi Australia Ltd (Mitsubishi) covering the first 10-years of HPA production from the plant.

Conservative (bank case) cash flow modelling of the project shows a pre-tax net present value of USD505.6million at a discount rate of 7.5%. The Project generates annual average net free cash of ~USD76million at full production (allowing for sustaining capital and before debt servicing and tax), with an attractive margin on HPA sales of ~63%. (Refer to ASX Announcement “Positive Final Investment Decision Study for 4,500TPA HPA project” dated 23 October 2017 for complete details. The Company confirms that as at the date of this announcement there are no material changes to the key assumptions adopted in the study).

The Company has been successful in securing senior project debt finance of USD190 million from German government owned KfW IPEX-Bank as senior lender. Altech has also mandated Macquarie Bank (Macquarie) as the preferred mezzanine lender for the project. The indicative and non-binding mezzanine debt term sheet (progressing through due diligence) is for a facility amount of up to USD90 million. To maintain project momentum during the period leading up to financial close, Altech has raised ~A$39 million in the last 24 months to fund the commencement of Stage 1 and 2 of the plant’s construction; Stage 1 construction commenced in February 2019 with Stage 2 early works completed at the end of June 2020.

Forward-looking Statements

This announcement contains forward-looking statements which are identified by words such as ‘anticipates’, ‘forecasts’, ‘may’, ‘will’, ‘could’, ‘believes’, ‘estimates’, ‘targets’, ‘expects’, ‘plan’ or ‘intends’ and other similar words that involve risks and uncertainties. Indications of, and guidelines or outlook on, future earnings, distributions or financial position or performance and targets, estimates and assumptions in respect of production, prices, operating costs, results, capital expenditures, reserves and resources are also forward-looking statements. These statements are based on an assessment of present economic and operating conditions, and on a number of assumptions and estimates regarding future events and actions that, while considered reasonable as at the date of this announcement and are expected to take place, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies. Such forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the control of the Company, the directors and management. We cannot and do not give any assurance that the results, performance or achievements expressed or implied by the forward-looking statements contained in this announcement will actually occur and readers are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements are subject to various risk factors that could cause actual events or results to differ materially from the events or results estimated, expressed or anticipated in these statements.